American Airlines (AAL.US) stock surged more than 70% in premarket trading after the company posted upbeat quarterly results. The airline $3.86 per share for its latest quarter, smaller than the $4.11 loss that Wall Street analysts had anticipated. Total operating revenue fell to $4.03 billion while the market expected a drop to $3.86 billion. Daily cash burn fell to $30 million in Q4. American did post an $8.9 billion annual loss for 2020 as the pandemic severely cut travel demand. The company expects that revenue in the first quarter will be 60%-65% lower compared to last year.

American Airlines (AAL.US) shares jumped 27% to 21.80 on the stock market today after soaring 70% in premarket trading. However price quickly pulled back and is currently testing support at $18.47. Today's wild swings come as heavily shorted stocks have become a battleground between retail investors and Wall Street hedge funds. Amateurs are betting those stocks will rise, resulting in massive spikes for AMC Entertainment (AMC.US) and GameStop (GME.US) recently. However, institutional investors gained advantage at the beginning of the US session, as various online brokerages made it harder to buy the heavily-shorted stocks that have been squeezed hardest in recent sessions. As a result, stock prices of the above companies fell sharply.

American Airlines (AAL.US), D1 interval. Source: xStation5

American Airlines (AAL.US), D1 interval. Source: xStation5

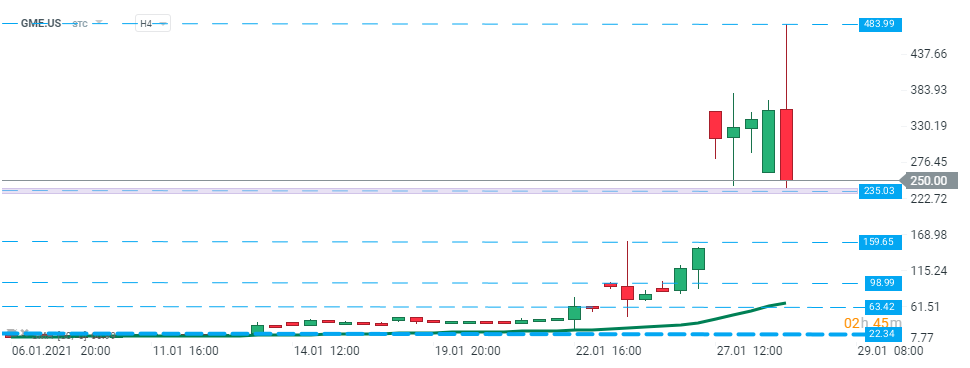

GameStop (GME.US), H4 interval. Source: xStation5

GameStop (GME.US), H4 interval. Source: xStation5

AMC Entertainment (AMC.US), H4 interval. Source: xStation5

AMC Entertainment (AMC.US), H4 interval. Source: xStation5