- Bitcoin gained even more than 7.0% in yesterday's session

- Why is Grayscale's win over the SEC so important?

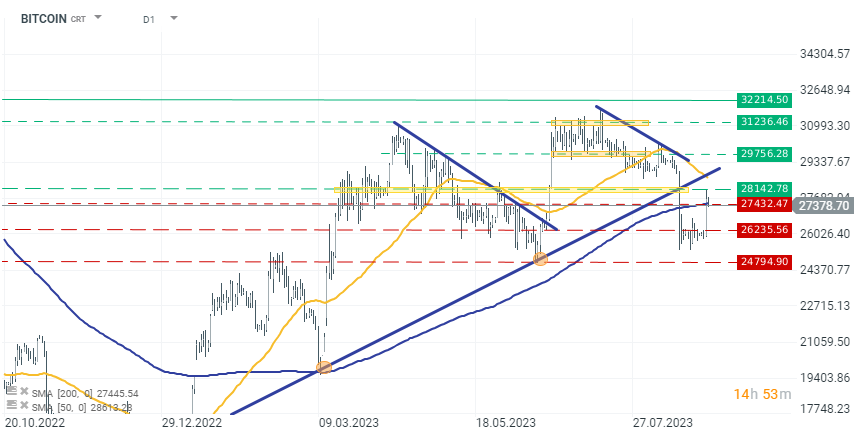

- Technically, BTC rebounded from a significant resistance zone

Bitcoin gained even more than 7.0% after Grayscale's legal victory over the SEC yesterday. The case concerned a decision by the U.S. Securities and Exchange Commission (SEC) to reject Grayscale's application to convert its over-the-counter Grayscale Bitcoin Trust (GBTC) into a listed Bitcoin exchange-traded fund (ETF). Grayscale had filed a lawsuit against the SEC, arguing that the denial was arbitrary and lacked sufficient explanation for why the SEC treated Bitcoin futures ETFs differently than spot Bitcoin ETFs. U.S. Court of Appeals Circuit Judge Neomi Rao sided with Grayscale, ordering that their petition for review be granted and the SEC's denial be vacated. The judge stated that the SEC failed to "offer any explanation" for its decision, thereby raising questions about the regulatory body's treatment of Grayscale's application. However, the judge's ruling doesn't automatically guarantee that a Grayscale spot Bitcoin ETF will be listed.

Both parties now have 45 days to appeal the court's decision, which could potentially escalate the case to the U.S. Supreme Court or lead to an en banc panel review. The SEC has not yet indicated whether it plans to challenge the ruling, but industry experts believe that the arrival of spot Bitcoin ETFs in the U.S. is imminent, possibly as early as the first quarter of 2024.

Grayscale's CEO, Michael Sonnenshein, has stated that their legal team is "actively reviewing" the court's decision. With the court ruling in hand, Grayscale is likely to continue pushing for its spot Bitcoin and possibly Ethereum ETF applications, considering that it views this as a watershed moment for the crypto industry. If no appeals are made within the 45-day period, this case could pave the way for Grayscale and other companies to bring crypto-based financial products to a broader market.

After this decision, the cryptocurrency market exploded. BTC gained over 7.0%, ETH over 5.0%, and some altcoins even more. However, sentiment towards BTC remains either negative or neutral, as evidenced by the significant pullback in the cryptocurrency today, rather than a continuation of gains. The price reacted to key support around $28,000, and since then, selling pressure has been pushing the price downward. Currently, BTC is trading at $27,400, and if the trend continues, a return below $27,000 is possible.