Polish zloty is not doing well in recent days. The current week started calmly, but on Tuesday and Wednesday the zloty was under selling pressure. Interestingly, the zloty was trading lower despite the generally good sentiment on the global stock market, which in theory should support emerging market currencies. However, the recent sell-off of the zloty is caused by reports that the polish central bank (NBP) may cut interest rates in the first quarter of 2021. Speculations about this appeared after the bank Chairman A. Glapiński said that although the current level of interest rates in Poland is appropriate and corresponds to the current situation, a reduction is possible in Q1. He also said that the NBP was analyzing the current situation and possible effects that could be caused by lowering the interest rates.

There have been speculations on the market that it may be a verbal intervention aimed at weakening the zloty before today's fixing, which was set at the level (EUR / PLN 4.6148) and thus generating a higher NBP profit that could support the state treasury (weaker the zloty means that the value of the reserves is increasing). If it was indeed the goal of the NBP, then a correction on the pairs with the Polish zloty is possible.

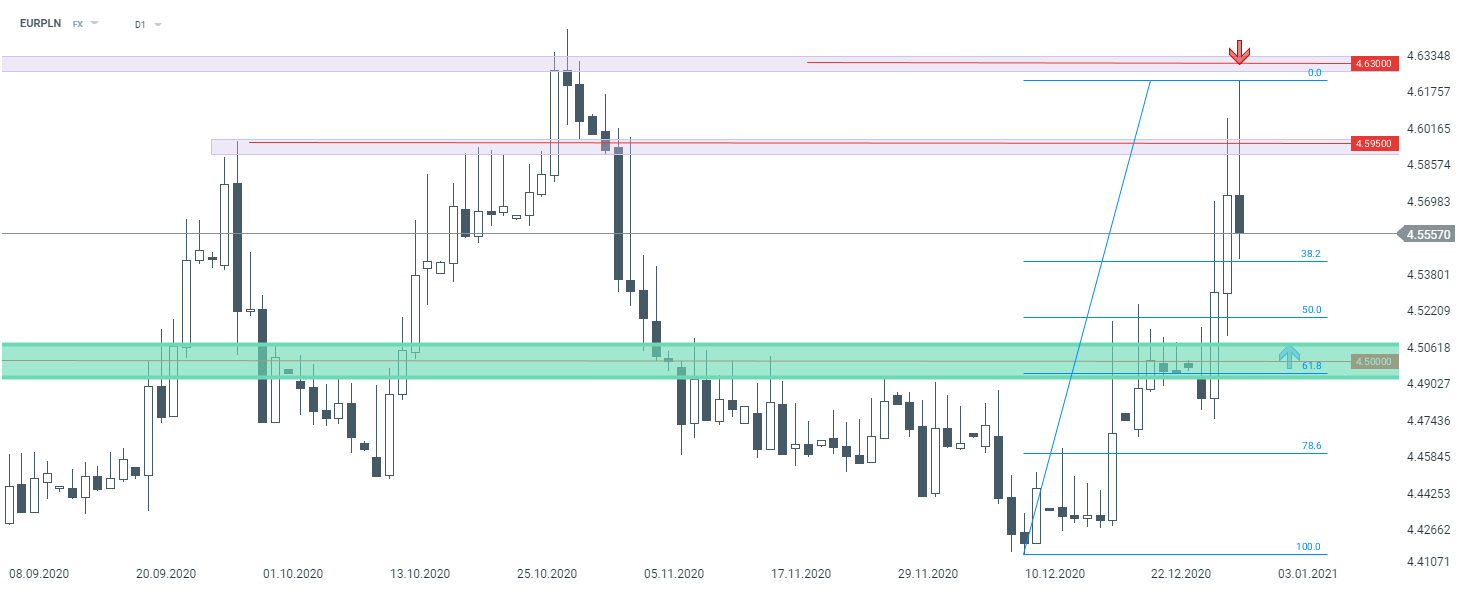

The zloty started to recover recent losses after today's NBP fixing. Source: xStation5

The zloty started to recover recent losses after today's NBP fixing. Source: xStation5