- Wall Street open higher after soft US CPI reading

- Headline US inflation drops below core gauge for the first time since late-2020

- American Airlines project lower-than-expected EPS in Q1 2023

Wall Street launched today's cash trading higher as risk assets caught a bid following softer than expected US CPI print for March. Headline inflation dropped from 6.0 to 5.0% YoY (exp. 5.2% YoY) while core gauge climbed from 5.5 to 5.6% YoY as expected. It means that US core CPI is now higher than headline CPI - the first such situation since late-2020. This is possible thanks to a negative contribution from fuel inflation as oil prices dropped significantly year-over-year. Market odds of a 25 basis point Fed rate hike at the May meeting are still higher than 50% but have dropped following CPI data today. Nevertheless, acceleration in the core gauge should be seen as a source of worry.

Fuel contributed negatively to US CPI reading for March. Source: Bloomberg, XTB

Fuel contributed negatively to US CPI reading for March. Source: Bloomberg, XTB

Wall Street caught a bid after dovish CPI print. Taking a look at Nasdaq-100 (US100) chart at D1 interval, we can see that the index tested a recently-broken price zone near 38.2% retracement, this time as a support, and bulls managed to defend it. However, much of the post-CPI gain was already erased. The index continues to trade within an upward channel and a positive price reaction to support retest suggests that upward move may be about to accelerate. In such a scenario, the first resistance zone to watch can be found ranging around 50% retracement in the 13,620 pts area.

Source: xStation5

Source: xStation5

Company News

Bed, Bath & Beyond (BBBY.US) trades higher today after the company informed that it raised $48.5 million via at-the-market share offering as of April 10, 2023. The company aims to raise as much as $300 million by April 26, 2023 as it seeks funds to avert bankruptcy.

Emerson Electric (EMR.US) is set to buy National Instruments for $8.2 billion in a cash transaction. An offer translating to $60 per share, represents an over-14% premium over yesterday's closing price ($52.58).

American Airline stock (AAL.US) trades slightly lower after the company said it expects adjusted EPS for Q1 2023 to come in at $0.01-0.05, lower than $0.06 in analysts' median forecast. Company reported a preliminary Q1 revenue at $12.19 billion - more or less in-line with $12.21 billion expected by the market.

Analysts' actions

- Global Payments (GPN.US) was upgraded to "buy" at Goldman Sachs. Price target set at $127.00

- Las Vegas Sands (LVS.US) rated "buy" at Roth MKM. Price target set at $74.00

- Dow (DOW.US) upgraded to "overweight" at Piper Sandler. Price target set at $118.00

- LyondellBasell (LYB.US) upgraded to "overweight" at Piper Sandler. Price target set at $68.00

- Confluent (CFLT.US) upgraded to "overweight" at Morgan Stanley. Price target set at $30.00

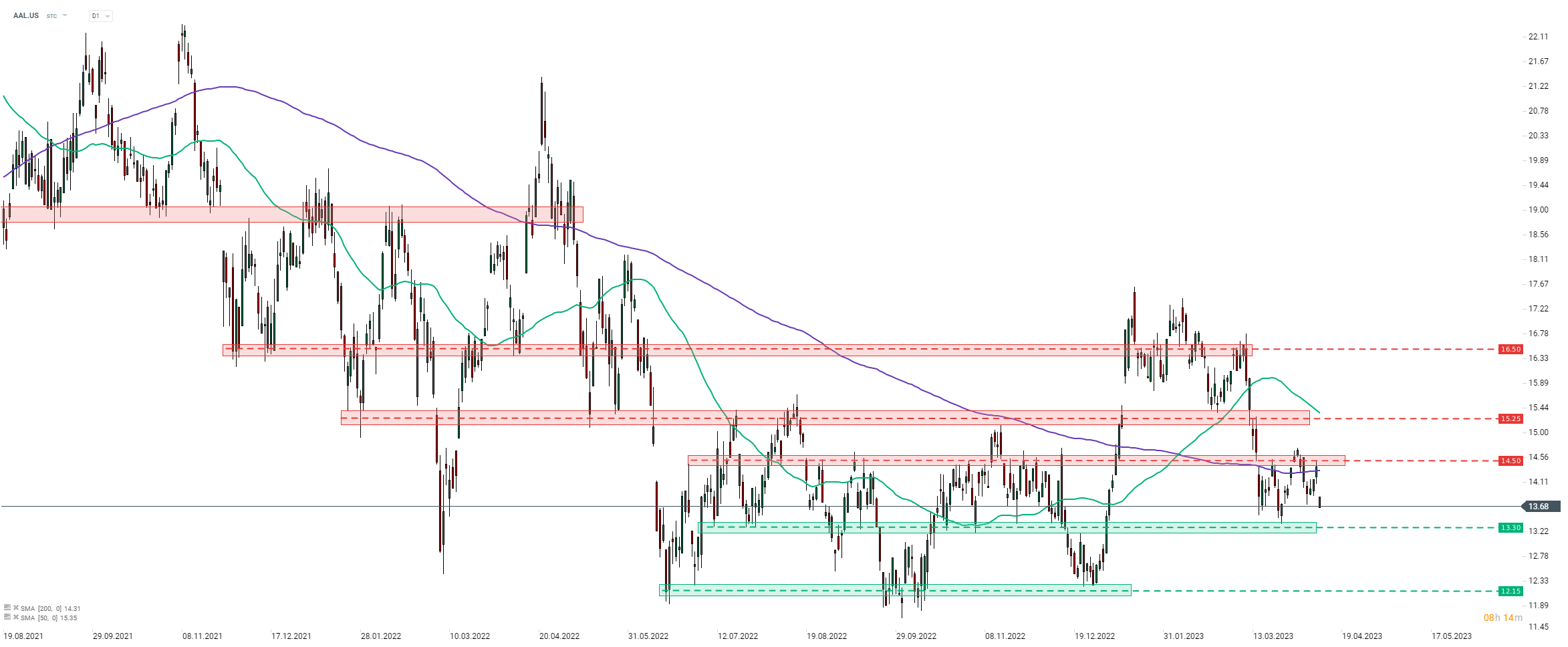

American Airlines (AAL.US) launched today's trading lower after the company warned that it is likely to miss Q1 earnings estimates. Stock is pulling back from the $14.50 resistance zone and unless bulls manage to regain control over the market, price may look towards a near-term support in the $13.30 area. Source: xStation5

American Airlines (AAL.US) launched today's trading lower after the company warned that it is likely to miss Q1 earnings estimates. Stock is pulling back from the $14.50 resistance zone and unless bulls manage to regain control over the market, price may look towards a near-term support in the $13.30 area. Source: xStation5