- Wall Street is set to open slightly higher today

- ISM and Durable Goods orders came much worse than expected

- First new debt influx

- Apple shares at all time high!

Wall Street opened slightly higher today, with the US500 index rising by 0.01% to 4,290 points and the US100 index seeing a 0.3% increase to 14,620 points. This comes as US stocks gently ascended following last week's substantial rally. Notably, Apple shares soared to an intraday high record in anticipation of the launch of its $3,000 mixed-reality headset today. Furthermore, Treasury yields experienced a drop and the US dollar weakened in response to the newly published ISM and Durable Goods data.

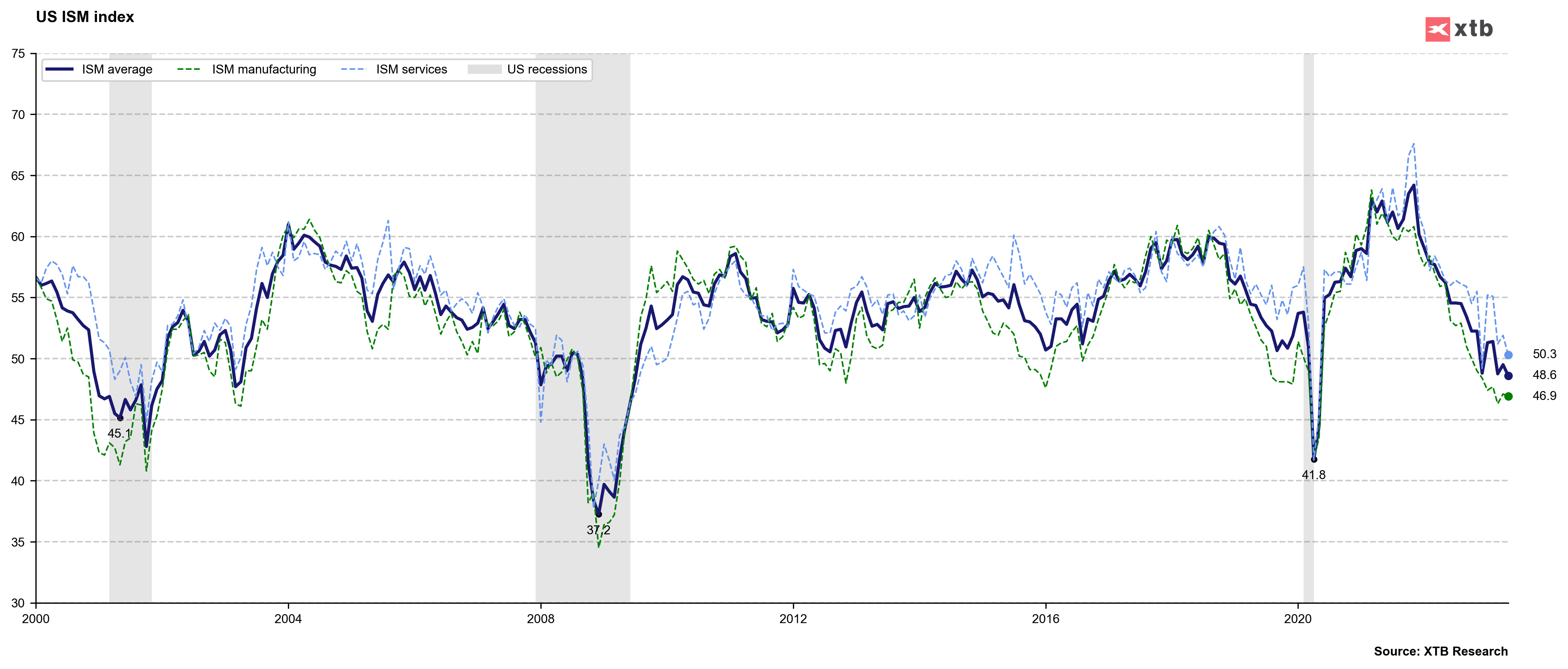

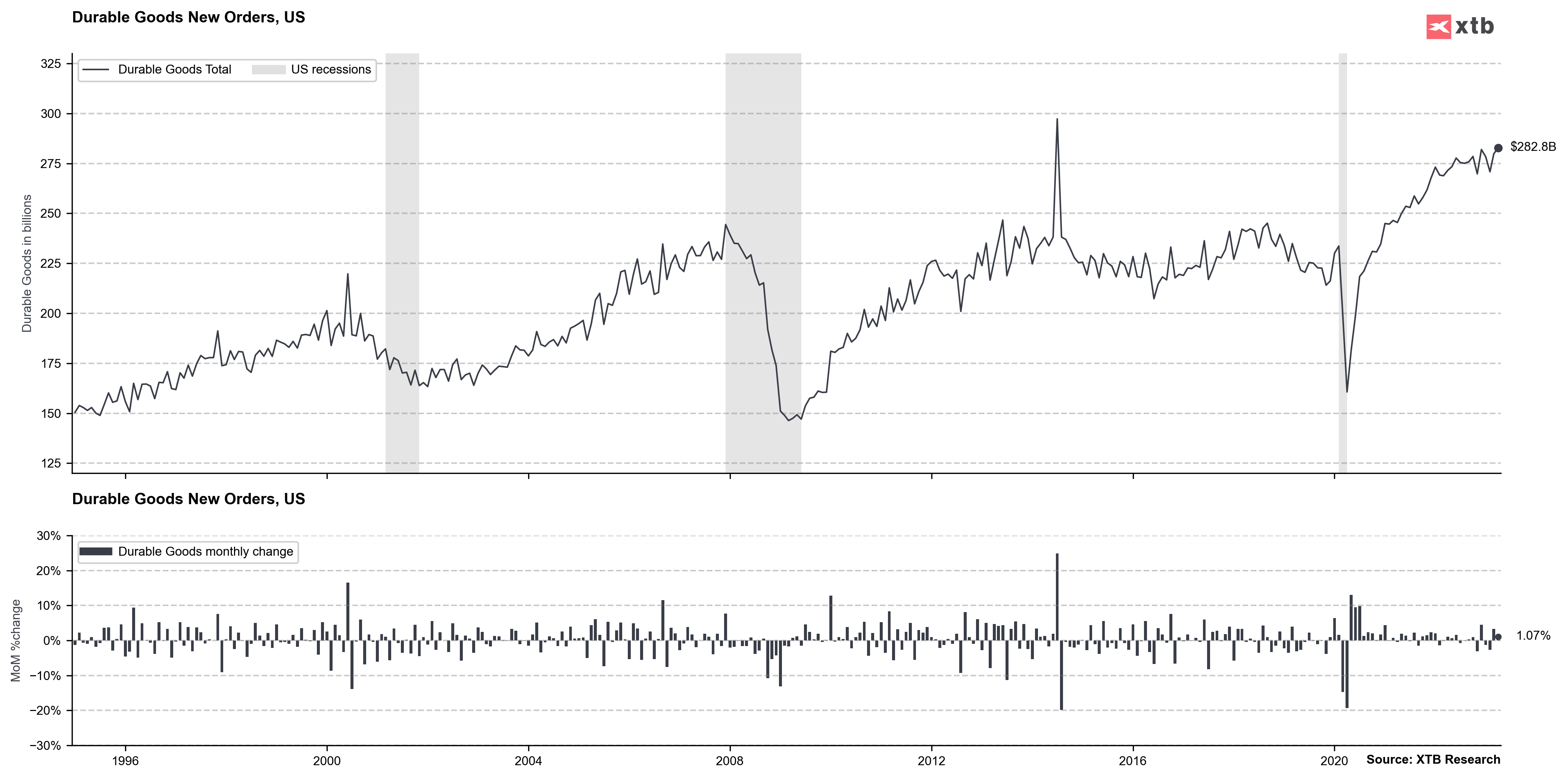

In May, the US service sector nearly stagnated as business activity and orders decreased and a measure of prices paid hit a three-year low. According to the Institute for Supply Management (ISM):

- the overall gauge of services fell to 50.3, the weakest level this year, indicating a bare separation between growth and contraction;

- the business activity index fell to a three-year low of 51.5, showing sluggish demand in service providers;

- the new orders gauge also declined, allowing service providers to reduce backlogs at the fastest pace in 14 years.

While eleven industries reported growth, led by accommodation and food services, seven reported a decrease. Amid higher interest rates and tighter credit conditions, softer demand is helping to reduce inflationary pressures. However, a rise in inventories suggests potential further weakness in factory output. Despite the ISM services employment index falling to its lowest since October, government data showed a larger-than-expected gain in May payrolls. After this release, the market estimates a 19% chance of a 25 basis point rate hike at the June FED meeting.

US Debt

A cascade of new US debt is coming, starting with auctions of $173 billion of bills today. JPMorgan forecasts that the resultant drain on liquidity will intensify the effect of Quantitative Tightening (QT) on stocks and bonds, potentially slashing nearly 5% off their collective performance this year. Additionally, Citi projects a median drop of 5.4% in the S&P over a two-month period and a 37-basis point shock to high-yield credit spreads.

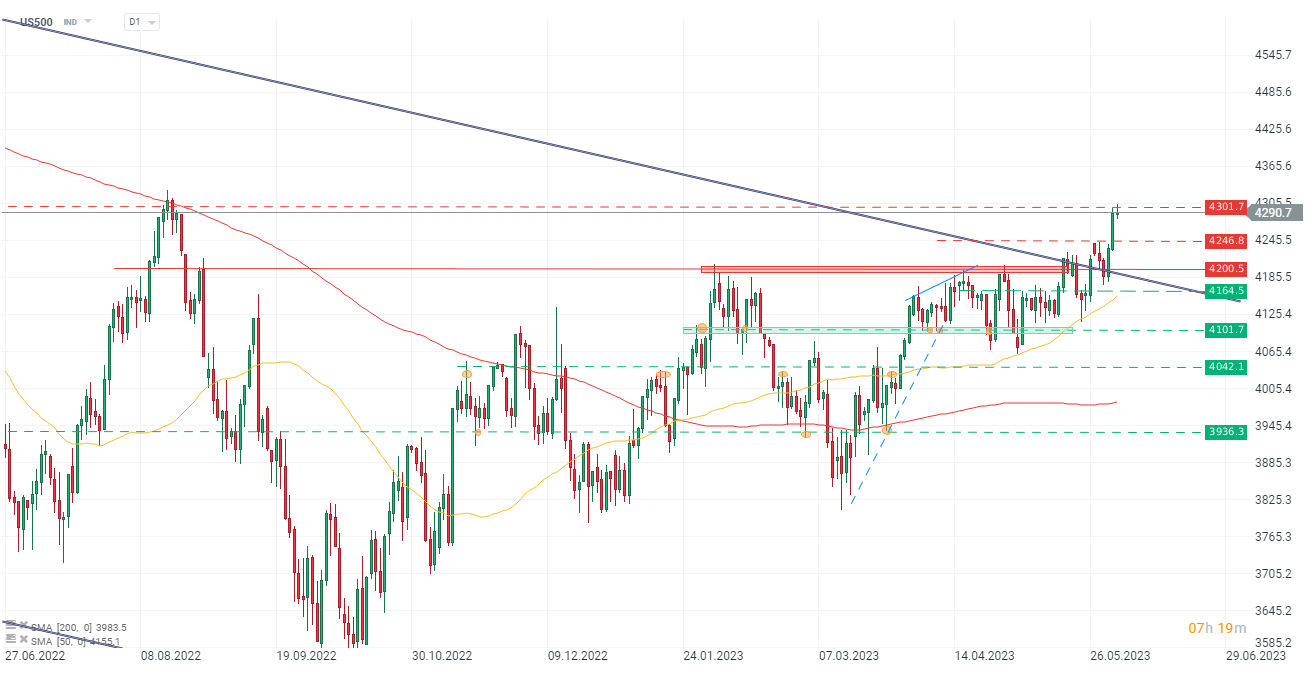

US500 index is currently trading at 4,290 points. This marks the third consecutive day of gains, following a significant rally at the end of last week. Notably, the price has broken above the downward channel, which is marked with a blue line. Bull can struggle to break above 4,300 level, where a resistance begins, it could be a crucial price level to monitor. If the price manages to break through this resistance, we could see further upward movement. However, if the price fails to surpass this level, we may witness a short-term pullback or consolidation around this area.

US500 index is currently trading at 4,290 points. This marks the third consecutive day of gains, following a significant rally at the end of last week. Notably, the price has broken above the downward channel, which is marked with a blue line. Bull can struggle to break above 4,300 level, where a resistance begins, it could be a crucial price level to monitor. If the price manages to break through this resistance, we could see further upward movement. However, if the price fails to surpass this level, we may witness a short-term pullback or consolidation around this area.

Company News:

- Apple Inc. (AAPL.US) is on pace to close at a record high ahead of its most significant product launch event in nearly a decade, after benefiting from a broader rotation back into technology stocks. Shares are up 2.0%.

- ImmunoGen (IMGN.US) shares gain 6.4% after the biotech company provided full results from its late-stage trial for its treatment of ovarian cancer.

- Oil-related stocks rise in US premarket trading after Saudi Arabia announced it would scale back oil output by a further 1 million barrels a day in July, taking the OPEC+ member’s production to the lowest level for several years after a slide in crude prices. Chevron (CVX.US), Exxon Mobil (XOM.US) and Occidental Petroleum (OXY.US)

- Palo Alto Networks Inc. (PANW.US) shares gain 3.0% in premarket trading on Monday, following a Friday announcement that the stock is set to replace Dish Network Corp. in the S&P 500