- Wall Street indices open little changed

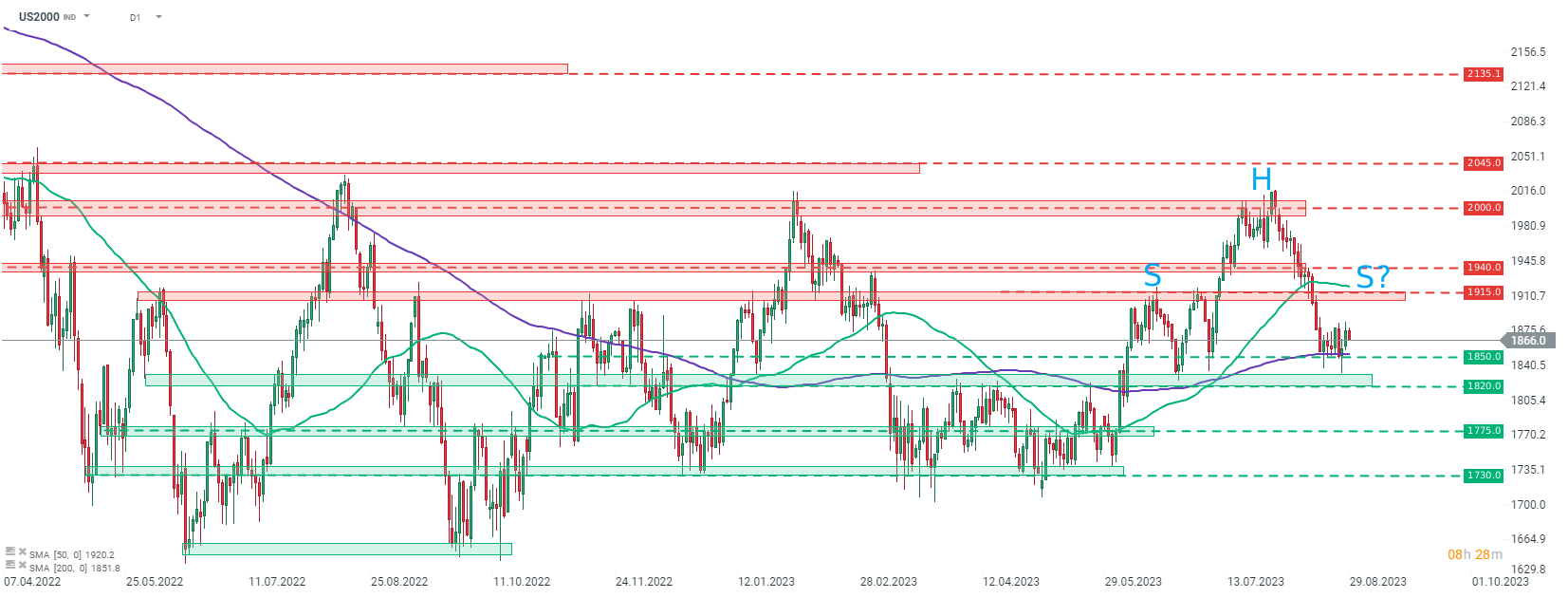

- Potential head and shoulders pattern on US2000

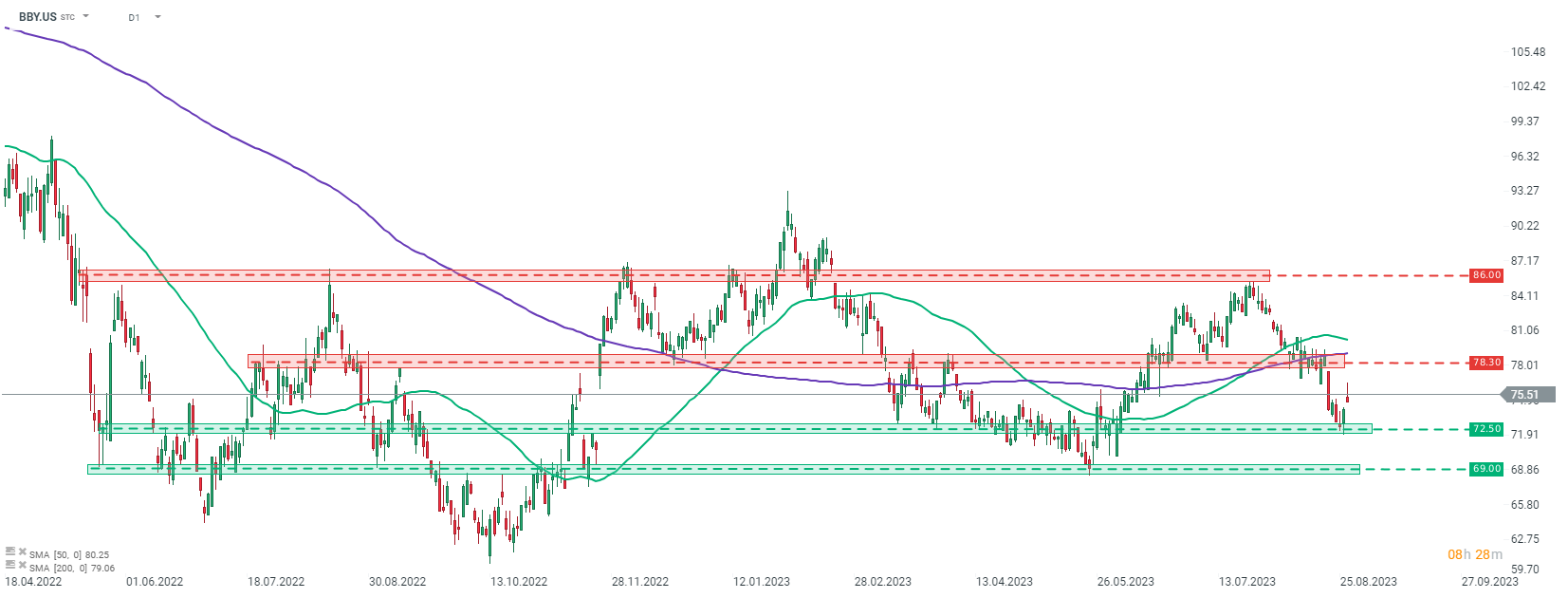

- Best Buy reports solid fiscal-Q2 earnings

Wall Street indices launched today's trading little changed. S&P 500 was flat at the opening, Dow Jones and Nasdaq traded 0.1% down and Russell 2000 opened 0.2% lower. Economic calendar for today is light. Traders will be offered Conference Board consumer confidence reading for August at 3:00 pm BST. Expectations are for a drop to 116.1 from 117.00 reported in July.

Source: xStation5

Source: xStation5

US2000 is trading slightly lower today. Index has recently bounced off the 1,850 pts support zone, marked with previous price reactions as well as the 200-session moving average (purple line) but bulls struggle to extend rebound. However, if the index catches a bid the 1,915 pts area should be on watch. A failure to break above this zone could mean that the right should of a head and shoulders pattern is being painted and may herald that a bigger drop is looming. However, in such a scenario a drop below the aforementioned 1,850 pts area would be needed as it would be the neckline of this potential technical setup.

Company News

Nio (NIO.US) reported a $835.1 million net loss in the second quarter, more than double of last year's loss. Adjusted loss per share reached $0.45, compared to -$0.33 expected. Revenue came in at $1.21 billion (exp. $1.27 billion). Gross margin on vehicles dropped from 16.7% in Q2 2022 to 6.2% now. Nevertheless, the company is optimistic about the future and expects solid growth in deliveries in the second half of 2023. Q3 deliveries target is now 55,000-57,000, up from 31.6 thousand delivered in Q3 2022. Q3 revenue is expected at $2.61-2.69 billion, up from $1.83 billion a year ago.

Best Buy (BBY.US) is trading higher after reporting earnings for fiscal-Q2 (calendar May-July 2023). Company reported revenue at $9.58 billion (exp. $9.52 billion) and adjusted EPS of $1.22 (exp. $1.06). Company said that slump in sales of electronics and household appliances is showing signs of easing and that next year should bring stabilization. Full-year revenue outlook was narrowed to $43.8-44.5 billion from $43.8-45.2 billion. Full-year adjusted EPS is seen at $6.00-6.40, compared to previous guidance of $5.70-6.50.

Analysts' actions

- AT&T (T.US) was upgraded to 'buy' at Citi. Price target set at $17.00

- Verizon Communications (VZ.US) was upgraded to 'buy' at Citi. Price target set at $40.00

- Oracle (ORCL.US) was upgraded to 'buy' at UBS. Price target set at $140.00

Best Buy (BBY.US) gained in the premarket after the release of fiscal-Q2 earnings but erased all of those gains before the cash session was launched. Stock bounced off the $72.50 support yesterday and should this rebound extend, a test of the $78.30 resistance zone may come next. Source: xStation5