-

Wall Street follows into footsteps of European peers and opens lower

-

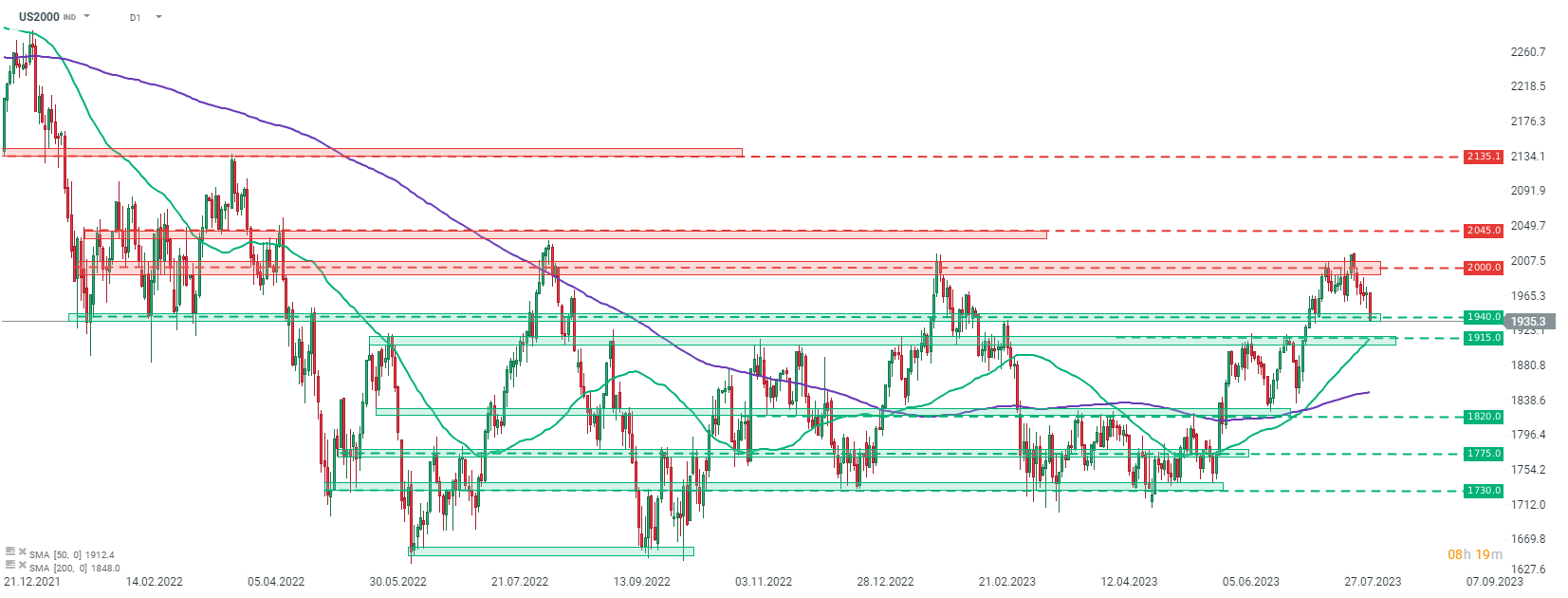

Russell 2000 leads declines on Wall Street

-

Eli Lilly surges to all-time highs after stellar Q2 earnings

Wall Street indices launched today's cash session lower. This comes amid an overall deterioration in risk moods that can be observed today. Weak trade data from China as well as introduction of windfall tax on Italian banks set the mood for the European trading session and those moods are extending into the US trading.

S&P 500 launched today's trading around 0.6% lower, Dow jones dropped 0.7% at the opening while Nasdaq was over 0.8% down. Small-cap Russell 2000 was top laggard with an over 1.5% drop at the opening.

Source: xStation5

Source: xStation5

Small-cap Russell 2000 (US2000) is the worst performing major US index at the beginning of today's Wall Street cash session. The index is down over 1.5% and is attempting to break below the 1,940 pts support zone. Should bears succeed, declines may deepen towards the next support zone in-line which can be found at 1,915 pts. This zone is marked with previous price reaction as well as 50-session moving average (green line) and should offer some support for the price.

Company News

Eli Lilly (LLY.US) reported an 85% YoY jump in Q2 net income, to $1.76 billion. Adjusted EPS reached $2.11 (exp. $1.98) while revenue was 28% YoY higher at $8.31 billion (exp. $7.58 billion). Results were driven by strong sales of Eli Lilly's drugs and encouraged the company to lift forecast. Eli Lilly now expects full year revenue to reached $#33.4-33.9 billion, up from previous guidance of $31.2-31.7 billion, and adjusted EPS to reach $9.70-9.90 range, up from previous forecast of $8.65-8.85.

Tilray (TLRY.US) shares jumped after the company announced that it will buy 8 craft beer and beverage brands from Anheuser-Busch (BUD.US). Deal includes acquisition of breweries, brewpubs as well as current employees. The acquisition will make Tilray the fifth largest craft beer brewer in the US with 5% market share and is expected to result in pro-form revenue increase of around $300 million annually. Financial details were not disclosed.

International Flavors & Fragrances (IFF.US) slumped after reporting disappointing Q2 results. EPS slumped 44% YoY to $0.86 while the market expected $1.10. Revenue dropped 11.4% YoY to $2.93 billion (exp. $3.1 billion). Company also cut full-year revenue guidance from $12.3 billion to $11.3-11.6 billion. Full-year adjusted operating EBITDA is expected in the $1.85-2.0 billion range, down from "approximately $2.34 billion".

Eli Lilly (LLY.US) surged after solid Q2 earnings and full-year forecast upgrade. Shares are up over 13% on the day, trading at fresh all-time highs above $500! Source: xStation5

Eli Lilly (LLY.US) surged after solid Q2 earnings and full-year forecast upgrade. Shares are up over 13% on the day, trading at fresh all-time highs above $500! Source: xStation5