GBPUSD is at lowest since March and EURGBP at highest since July ahead of BoE interest rate decision.

Rate hike decision

Today at 12:00 am BST the Bank of England will publish its interest rate decision. There is talk in foreign media of a "knife-edge" or so-called "close call" decision. The recent strong wage growth indicated that a hike was almost certain and the market was pricing the probability of such a move at 70%. However, yesterday's inflation reading caused the probability of a hike to drop by 50 bps. What decision awaits us from the BoE?

Expectations for a hike have fallen below 50%, but on the other hand, one full hike is priced in by the end of the year. Source: Bloomberg Finance LP

CPI inflation in the UK fell for August to 6.7% y/y, and core inflation fell as low as 6.2% y/y. Interestingly, we learned earlier about wage data, where the 3-month average showed as much as 8.5% y/y growth, which would theoretically imply mounting inflationary pressure. Source: Bloomberg Finance LP, XTB

CPI inflation in the UK fell for August to 6.7% y/y, and core inflation fell as low as 6.2% y/y. Interestingly, we learned earlier about wage data, where the 3-month average showed as much as 8.5% y/y growth, which would theoretically imply mounting inflationary pressure. Source: Bloomberg Finance LP, XTB

What will the BoE decide?

The Bank of England could theoretically follow in the footsteps of the Fed and SNB, which kept interest rates unchanged. In the former case, however, the decision was received hawkishly, and in the latter, dovishly, despite the fact that further hikes were announced. Goldman Sachs and Nomura point to keeping interest rates unchanged, looking at large declines in inflation. On the other hand, a "dovish hike," as the European Central Bank did, is a very likely scenario. It is worth noting that the BoE has been reluctant to raise interest rates in recent months, but this was due to excessive inflation. Now the BoE basically has an excuse for not raising, but at the same time it is also a good time to raise one last time. The scenario of a hawkish reception of a hold on a hike, as was the case with the Fed, seems unlikely.

During its previous decision in early August, the Bank of England stressed that if there were signs of pressure on inflation, rates would be raised again. Such an indication came from wages. JP Morgan points out that the current level of rates, even if maintained for an extended period, does not give the BoE confidence in reaching its inflation target. Bloomberg Economics, on the other hand, says that wages are reason enough for a hike to take place, but at the same time there will be communication that this will be the last hike.

How will the market behave?

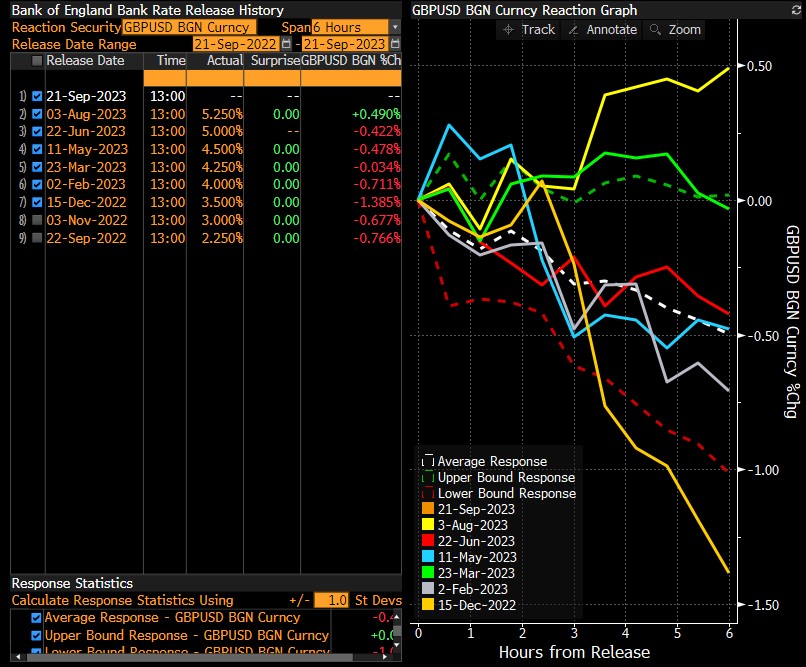

For the most part, GBPUSD lost after the rate decisions. Interestingly, in August, GBPUSD gained, which was related to comments on a possible next hike.

GBPUSD changes after the decisions. Source: Bloomberg Finance LP

GBPUSD changes after the decisions. Source: Bloomberg Finance LP

GBPUSD is falling below the local low from May. The key support is 1.2100. However, if the BoE will be hawkish, a test of the 250-session average near 1.2420 is not ruled out.

Source: xStation5

EURGBP is clearly on the rise, overcoming local peaks from August 10. A dovish BoE could lead the EURGBP above 0.87. Important resistance is also located at the local lows of January and March about 40 pips higher. The extent of a breakout from the triangle may suggest an approach near 0.8780.

Source: xStation5