-

Wall Street indices finished yesterday's trading mixed. S&P 500 gained 0.08%, Nasdaq moved 0.39% higher while Dow Jones dropped 0.68%. Small-cap Russell 2000 plunged 1.17%

-

FOMC kept interest rates unchanged at a meeting yesterday. However, dot-plot suggested two more 25 bp rate hikes this year

-

Indices from Asia-Pacific traded higher today - Nikkei gained 0.2%, S&P/ASX 200 moved 0.3% higher, Nifty 50 ticked 0.1% higher and indices from China gained 0.4-1.8%. Kospi was a laggard and dropped 0.1%

-

DAX futures point to more or less flat opening of the European cash session today

-

People's Bank of China cut the 1-year medium-term lending facility rate by 10 basis points, from 2.75 to 2.65%. Such a decision was widely expected

-

It is said that PBoC may follow with a similar 10 bp cut to 5-year MLF rate next week

-

Chinese industrial production increased 3.5% YoY in May (exp. 3.8% YoY), retail sales surged 12.7% YoY (exp. 13.7% YoY) and urban investments increased 4.0% YoY (exp. 4.5% YoY)

-

Japanese exports were 0.6% YoY higher in May (exp. -0.8% YoY) while imports plunged 9.9% YoY (exp. -10.3% YoY)

-

Japanese machinery orders were 5.5% MoM higher in April (exp. 3.1% MoM)

-

New Zealand GDP contracted 0.1% QoQ in Q1 2023 (exp. -0.1% QoQ)

-

Australian employment increased by 75.9k in May (exp. +14.8k) while the unemployment rate dropped from 3.7 to 3.6% (exp. 3.7%)

-

JPMorgan lowered its Brent forecast for 2023 and now expects the price to average $81 per barrel throughout the year ($90 previously). WTI forecast was cut from $84 to $76 per barrel

-

Cryptocurrencies trade mixed today - Bitcoin and Ethereum drop 0.6% while Dogecoin and Ripple gain 0.1%

-

Energy commodities trade lower - oil drops 0.1% while US natural gas prices trade 1% lower

-

Precious metals pull back amid USD strengthening - gold drops 0.3%, platinum trades 0.8% lower and silver plunges 1.7%

-

AUD and USD are the best performing major currencies while CHF and JPY lag the most

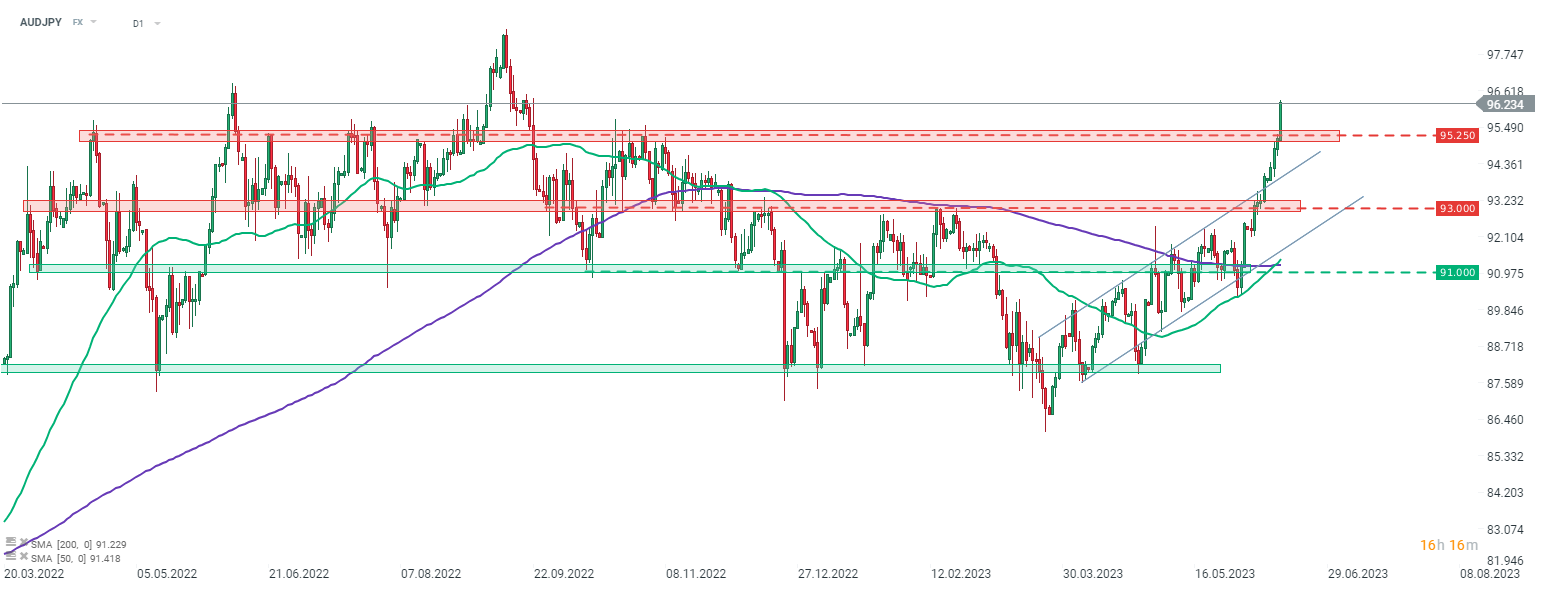

AUDJPY rallies today on the back of solid Australian jobs data and mixed Japanese trade data. The pair jumped above the 95.25 resistance zone and trades at levels not seen since late-September 2022. Source: xStation5

AUDJPY rallies today on the back of solid Australian jobs data and mixed Japanese trade data. The pair jumped above the 95.25 resistance zone and trades at levels not seen since late-September 2022. Source: xStation5